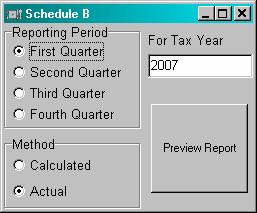

Method/Calculated:

Takes (OASDI wages + tips)*12.4%

+ (Medicare wages * 2.9%)

+ Federal withheld

Method/Actual: (OASDI wages + tips)*6.2%

+Actual OASDI withheld from employee

+ (Medicare wages * 1.45%)

+Actual Medical withheld from employee

+ Federal withheld.

These values can be different due to rounding.

Example: $10,000 of OASDI wages

Calculated: 10000*12.4%=1240.00

Actual:10000*6.2%=620.00 +

3333.33*6.2%=206.66646=206.67

+3333.33*6.2%=206.66646=206.67

+3333.34*6.2%=206.66708=206.67

=1240.01